Business reporter, BBC News

Getty Images

Getty ImagesUK government borrowing was lower than expected in July, following a rise in tax and National Insurance receipts.

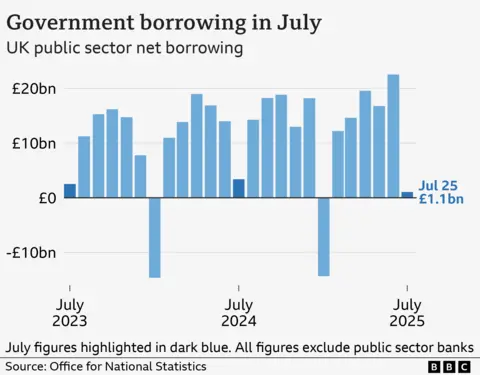

Borrowing – the difference between public spending and tax income – was £1.1bn in July, which was £2.3bn less than the same month last year, the Office for National Statistics (ONS) said.

It was the lowest July figure for three years, the ONS said, and was helped by a rise in self-assessed income tax payments.

Despite the lower-than-expected figure, analysts said the chancellor was still likely to have to raise taxes in the autumn Budget to meet her tax and spending rules.

Borrowing over the first four months of the financial year has now reached £60bn, the ONS said, which is up £6.7bn from the same period last year.

That total for the year so far is in line with what the Office for Budget Responsibility (OBR), the official independent forecaster, had predicted in March.

Borrowing in July tends to be lower because of the timing of income tax receipts and the ONS said income from self-assessment tax returns was £15.5bn last month, up £2.7bn from a year earlier.

There was also an increase from National Insurance (NI) contributions, following the rise in employers’ NI rates in April.

Despite the better-than-expected figures for July, Paul Dales, chief UK economist at Capital Economics, told the BBC’s Today programme they did not change the “predicament” Chancellor Rachel Reeves faces over what she will do in the Budget, adding that it felt like tax rises were “inevitable”.

“We think she’s on track to miss her fiscal rule by something like £17bn, which means she’ll need to raise that amount of money, or if she wants the same buffer against the fiscal rule as back in March of £10bn she might have to raise something like £27bn in the Budget, which is quite a big task.”

There has been speculation that the freeze on income tax thresholds, which is due to end in 2028, could be extended. The freeze means that, over time, more people are dragged into paying higher tax rates.

In recent days, there have also been reports that Reeves is considering reforming property taxes.

The chancellor is following two main self-imposed rules for government finances:

- day-to-day government costs will be paid for by tax income, rather than borrowing

- to get debt falling as a share of national income by the end of this parliament in 2029-30

Dennis Tatarkov, senior economist at KPMG UK, said the “longer-term picture for public finances remains challenging”.

“The coming Budget is likely to focus on addressing any potential shortfall against current fiscal targets, which we estimate at £26.2bn. However, the assessment of the shortfall crucially depends on changes to the OBR’s forecast.”

There has been a wide range of forecasts for how much money Reeves might need to raise in the Budget to meet her rules.

One factor that will influence this is the latest growth forecast from the OBR. Small changes to the forecaster’s outlook can make a big difference to its projections for tax income over the years ahead.

The cost to the government of its U-turns on benefit cuts – that had been aimed at saving billions of pounds – will also be a factor, as will the interest rates on government borrowing.

Darren Jones, Chief Secretary to the Treasury, said: “Far too much taxpayer money is spent on interest payments for the longstanding national debt.

“That’s why we’re driving down government borrowing over the course of the parliament – so working people don’t have to foot the bill and we can invest in better schools, hospitals, and services for working families.”

Lib Dem Treasury spokesperson Daisy Cooper, said: “Getting the economy growing again and managing the public finances carefully to bring down the national debt, and to give businesses the confidence they need to invest, is critically important.

“That means ending the healthcare crisis, to get people off waiting lists and into work, bringing down sky-high energy bills, and rebuilding trade with our European neighbours.”

Summer growth after ‘sluggish spring’

Meanwhile, a separate survey release on Thursday suggested that private sector output growth has hit its fastest pace for a year.

The latest UK composite purchasing managers’ index (PMI) from S&P Global rose to 53.0 in August, up from 51.5 in July, where a figure over 50 indicates expansion.

Chris Williamson, chief business economist at S&P Global Market Intelligence, said the latest reading showed that “economic growth has continued to accelerate over the summer after a sluggish spring”, led by the services sector.

However, he added that demand “remains both uneven and fragile” with companies citing worries over the impact of government policy changes, as well as geopolitical uncertainty.