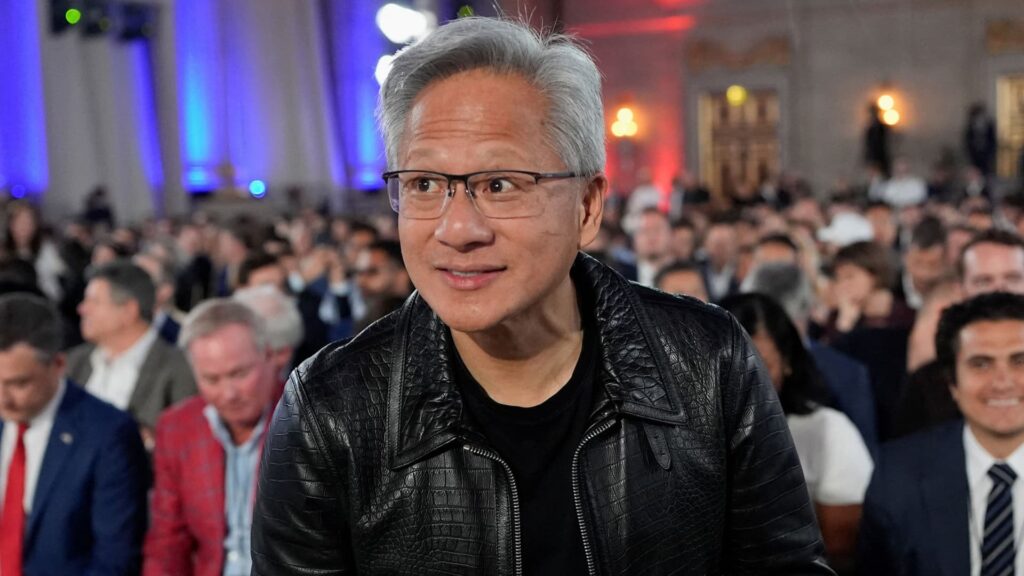

Nvidia CEO Jensen Huang attends the “Winning the AI Race” Summit in Washington D.C., U.S., July 23, 2025.

Kent Nishimura | Reuters

Nvidia reported better-than-expected earnings and revenue on Wednesday, and said sales growth this quarter will remain above 50%, signaling to Wall Street that demand for artificial intelligence infrastructure shows no sign of fading.

Nvidia shares fell in extended trading.

Here’s how the company did, compared with estimates from analysts polled by LSEG:

- Earnings per share: $1.05 adjusted vs. $1.01 estimated

- Revenue: $46.74 billion vs. $46.06 billion estimated

The company said it expects revenue this quarter to be $54 billion, plus or minus 2%, though that number does not assume any H20 shipments to China. Analysts were expecting revenue of $53.1 billion, according to LSEG.

The company’s 2026 second quarter results confirmed that Nvidia’s data center business remains entrenched in the unprecedented buildout of infrastructure for artificial intelligence.

Overall company revenue rose 56% in the quarter, Nvidia said.

During the quarter, after meeting with President Donald Trump, Nvidia signaled that it expected to get U.S. licenses to ship the H20 chip to China, a product that it said cost the company $4.5 billion in write downs and which could have added $8 billion in sales to the second quarter if it had been commercially available during the period.

Nvidia said it sold no H20 chips to China during the quarter, but the company said it benefited from the release of $180 million worth of H20 inventory to a customer outside of China.

Net income increased 59% to $26.42 billion, or $1.05 per diluted share, from $16.6 billion, or 67 cents per share, in the year-ago period.

Nvidia’s business is driven by its data center business, in which it sells chips called graphics processors and complimentary products for connecting and using them in large quantities. Revenue in the division rose 56% from the year-ago period to $41.1 billion.

Large cloud providers make up about half of Nvidia’s data center business, the company said in the previous quarter. Those customers are currently buying Blackwell chips, the company’s latest generation, and Nvidia said that Blackwell sales had rose 17% from the first quarter. Nvidia said in May that its new product line reached $27 billion in sales, accounting for about 70% of data center revenue.

Nvidia’s gaming division reported $4.3 billion in sales, up 49% from the year-ago period. The division used to be Nvidia’s largest before the AI boom supercharged its data center sales. Nvidia said during the quarter that its GPUs intended for gaming would be tuned to run certain OpenAI models on personal computers.

The company’s robotics division, which management has highlighted as a growth opportunity, remains a small part of Nvidia’s business, with $601 million in sales during the quarter, which was 32% growth on an annual basis.

Nvidia said that its board has approved an additional $60 billion in share repurchases, with no expiration date. Nvidia repurchased $9.7 billion in its stock during the quarter.

This is breaking news. Please check back for updates.