FTSE 100 hits 9,000 points for the first time ever

Newsflash: Britain’s blue-chip stock index has risen through the 9,000 point mark to hit a new record high.

The FTSE 100 share index hit 9,016.98 points at the start of trading in London, up around 0.2% today, taking its gains during 2025 to over 10%.

That’s a new intraday high for the “Footsie” (as it is known in City circles).

As covered in the introduction, the London stock market has benefitted from a range of factors this year, including a move by some investors to diversify away from the US stock market due to concerns over Donald Trump’s economic policies.

The Trump trade war has also helped UK stocks, as Britain is one of the few countries to have reached a trade deal guaranteeing lower tariffs.

Key events

Thames Water could be in contempt of Parliament if KKR minutes aren’t handed over

Thames Water’s top management have been warned they could be held in contempt of Parliament if they continue to refuse to hand over board minutes related to their proposed rescue deal with KKR, which collapsed last month.

The EFRA committee want to know why Thames plumped for KKR as its preferred partner, only to see the US private equity giant walk away in June, and also want to know why the KKR approach failed.

EFRA committee chair Alistair Carmichael tells Thames at this morning’s hearing:

“Can I just be quite clear about this?

In the event that we invoke the formal powers that Parliament has given us, not to provide these minutes will be a contempt of Parliament. Is that understood?”

Thames chair Sir Adrian Montague says the company “understand and respect the committee’s powers”, before arguing that it is inappropriate at this juncture to give these minutes, for several reasons.

Firstly, they contain confidential information concerning all the bidders; Thames are subject to confidentiality undertakings with regard to information.

Secondly, he says, the company is subjected to market abuse regulations which control the dissemination of material, non-public information.

The most important point, Montague argues, is that discussions over Thames’s future is at a “a very sensitive stage.”

Right now, it will be “really difficult to really counterproductive” to release these documents, he insists.

Montague also describes KKR’s bid as’ ‘exceptional’, adding that they didn’t give many reasons when they withdrew, but that KKR said they saw no financial or operational reason why they should not have been able to continue.

The government’s battle against red tape means it is proposing changes to rules brought in after the financial crisis to hold senior bankers to account.

The Treasury says it is consulting on reforms to the Senior Managers & Certification Regime, with the aim of “streamlining the regime to support growth and competitiveness”.

The SM&CR was brought in to hold senior managers accountable, following the disastrous decisions that led to the worst financial crisis since 1929, almost 20 years ago.

Today, though, the UK’s financial watchdogs – the Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA) – want to change it to drive growth in financial services.

The proposals include:

-

Give firms more time and flexibility to submit applications for approving new senior managers when there has been an unexpected or temporary change.

-

Strip out duplication where the same individuals are certified for separate functions, which would reduce the number of certification roles by 15%.

-

Provide guidance on how to streamline the annual checks firms need to undertake to certify individuals are ‘fit and proper’ to do their role.

-

Allow more time for firms to report updates to senior manager responsibilities.

-

Increase how long criminal record checks for senior manager applications are valid for, prior to application submission.

-

Help firms to better understand the definition of certain SMF roles.

-

Give firms more time to update the directory, which lists certified staff.

This streamlining may sound sensible. But, those who lived through the financial crisis of 2007-08 could be concerned that regulators are backsliding.

Indeed, the Treasury has launched a consultation about potentially developing a more proportionate replacement for the Certification Regime; significantly reducing the number of roles requiring regulatory pre-approval; and further streamlining the assessment process.

Sam Woods, chief executive of the PRA and deputy governor for prudential regulation at the Bank of England, suggests the new rules will still ensure ‘high standards’, saying:

“High standards of accountability are important for maintaining confidence in our financial services industry. Today’s changes will reduce the burden of the Senior Managers and Certification Regime without diluting accountability, and we will work with the government on further reforms.”

Alistair Carmichael then asks Thames about its lamentable record on pollution, with incidents up in the last year (see 7.59am post).

Carmichael points out that this morning’s annual report indicates that there was too much rain leading to overflows, shortly before Thames announced hose pipe bans!

Thames Water CEO Chris Weston says “I’m sorry about that”, before insisting that the weather is a reason, not an excuse.

He says:

Last winter, before we came into this spring, we had the second wettest winter on record. There were some months like last September, where the rainfall was more than double the normal monthly rainfall, and our system, I’m afraid, was never intended to deal with that.

We are taking huge steps to improve our position around pollutions. We are cleaning the network more than we ever have, and we are investing more than we ever have in our sewage treatment works, but it is going to take a while.

Weston then suggess that turning around and transforming Thames “is going to take Between five and 10 years. Maybe a bit more.”

This morning, he said this task could take at least a decade.

Thames Water chair apologises after being recalled before MPs

Over in parliament, the chair of Thames Water has apologised to MPs after the company was recalled before the Environment, Food and Rural Affairs Committee.

Sir Adrian Montague kicked off this morning’s session in a penitent manner, telling committee chair Alistair Carmichael MP:

“I’m making an apology. It’s rare, as you said yourself, for water companies or any company to be recalled to the committee. We regret that we have made that necessary.

We have tried to be as forthcoming as we can with our disclosures. We will no doubt go into some of the reasons behind the actions we’ve taken.

But I just wanted to say before we start, honestly, you’re all busy people. I’m sorry that we are taking up your time again.”

Carmichael had begun the session by telling Montague, CEO Chris Weston and non-executive director Ian Pearson, that Thames had been recalled after a ‘quite extraordinary session’ back in May.

Carmichael says the recall was triggered by Montague telling the committee he had “mis-spoken” in the first hearing, which Carmichael says came to light after an inquiry from the Guardian.

[Reminder: Montague told the committee that large bonuses for senior bosses which were to be paid from an emergency £3bn loan were insisted upon by creditors. We then reported that sources and court documents suggest the bonuses were agreed to by the creditors but not necessarily proposed by them.]

Carmichael says Thames have since provided “significant amounts of information”, which he thinks could have been handed over earlier if the company was committed to transparency.

He then accuses Thames of “quite a bit of gameplaying”, saying the committee only recieved a list of its senior creditors at 5.20pm yesterday, and pointing out that its annual report has been filed today, the last possible day.

The Treasury also point to the Bank of England’s decision, last week, to relax mortgage lending rules.

They say:

First-time buyers will be supported to get on the housing ladder, with the Bank of England allowing more lending at over 4.5 times a buyer’s income – which could help 36,000 more people buy a home over its first year and are helping Nationwide support an additional 10,000 first-time buyers by lowering income thresholds for its popular ‘Helping Hand’ mortgage from tomorrow.

Simplified mortgage lending rules being considered by the Financial Conduct Authority will also make it easier for existing borrowers to remortgage, while the introduction of a permanent government-backed Mortgage Guarantee Scheme will secure the availability of high loan-to-value mortgage products in times of economic uncertainty.

The new guidelines announced by the Bank of England last week mean that individual banks and building societies can offer more high loan-to-income (LTI) mortgages, which are equal to, or worth more than, 4.5 times a borrower’s annual earnings.

Rachel Reeves is also pledging to cut red tape, in a push to attract investment and drive growth.

Under the ‘Leeds’ reforms just announced, “unnecessary financial red tape” will be “drastically cut”, the Treasury says.

They add:

A new concierge service within the Office for Investment will harness UK networks globally to actively court international financial services companies, creating a one-stop-shop to promote the UK and provide tailored support to help businesses plan where to invest based on their needs – better harnessing specialist clusters across the country from asset management in Edinburgh, to Fintech in Leeds and Cardiff, and insurance in Norwich and Norfolk.

Government to consider reforms to Isas

A key part of the new ‘Leeds’ financial services reforms is a push to encourage people to invest more.

The Treasury says the UK has the lowest level of retail investment among G7 countries – that deprives businsses of capital, and means savers may miss out on returns.

So, there is going to be a new ‘industry-led ad campaign’ to explain the benefits of investing to the public (which feels slightly odd, as investment firms do this anyway).

From next April, the Financial Conduct Authority will allow banks to alert customers about specific investment opportunities to consider shifting money from a low-return current accounts to higher-performing stocks and shares investments.

There’s also going to be a review of risk warnings on investment products, “to make sure they help people to accurately judge risk levels”.

There has been speculation in recent weeks that Rachel Reeves could cut the amount of cash people could save in an Isa (a tax-free investment and savings account), to encourage people to put money into stocks and shares instead and boost the economy. That idea has been paused, though, after a backlash from the industry.

Instead, the government says it will “continue to consider reforms to Isas and savings” to achieve the right balance between cash savings and investment.

But as a first step, saves will be allowed to hold Long Term Asset Funds in Stocks & Shares Isas next year. This, they say, will help people to invest in assets such as innovative businesses and infrastructure – which could drive growth, and “can also deliver better returns”.

There’s an investing mantra that people should only put money into the markets which they’re prepared to risk.

The Treasury, though, is hailing the potential benefits of investing, saying:

Stocks and shares have performed significantly better than cash savings accounts in recent decades. According to some industry estimates, more than 29 million adults across the UK have cash sitting in a low-interest rate account offering around 1% – while the average return for stocks and shares over the last 10 years is around 9%. If those savers invested £2000 today, they could have £12,000 in 20 years’ time. This compares to £2,700 if they held this money in a cash account offering 1.5% at the current interest rate, making them over £9,000 better off.

This is a timely point, with the FTSE 100 share index at its record high today…

Reeves presents ‘Leeds reforms’ for financial services

Over in Leeds, Chancellor Rachel Reeves is setting out “the biggest reforms to financial services for much more than a decade”.

Setting out the “Leeds reforms” in the West Yorkshire city, she says the government is aiming to “really invigorate our financial services sector”, and thus reinvigorate the whole economy.

PA Media report that Reeves told finance chiefs in Leeds:

“We are fundamentally reforming the regulatory system, freeing up firms to take risks and to drive growth.

“Second, we’re providing certainty for banks operating in the UK, and ensuring that UK banks have the ability to compete internationally and drive economic growth.

“Third, we’re doubling down on making the UK an innovation capital and the place of choice for fintechs to start up, to scale up and to list in the UK.

“Fourth, we’re seizing opportunities in areas where we are already world leading, including asset management, sustainable finance and specialty insurance.

“And fifth, we are delivering prosperity by increasing the firepower of our capital markets and boosting retail investment.”

Reeves added that finance firms need to use these reforms to help the economy:

“The measures today, the Leeds reforms, do represent the widest set of reforms to financial services for more than a decade.

“We now need to work together to bring these to life, to make sure – whether it is more first-time buyers getting access to mortgages, more businesses getting access to capital to start up, to scale up, and then ultimately to list in the UK – that is now our job.

“We’re giving you the tools we now need to work together to achieve that in reality.”

Compensation rates cut for financial firms who harm consumers

Kalyeena Makortoff

Adding to the raft of regulatory announcements being made on Mansion House day, the Financial Ombudsman Services is effectively slashing costs for banks and financial firms which are deemed to have harmed consumers.

The changes relate to the interest rate usually applied to the compensation owed to consumers, with the FOS saying it was “revising the rate to better reflect market conditions”.

At the moment, the rate is 8%, while the new rate will be +1% (that is, one percentage point) above the Bank of England’s base rate – which is currently 4.25%.

The FOS said the previous rate was due for reform, given it remained “unchanged for nearly 25 years despite significant shifts in the economic landscape and interest rate environment.”

Given that the last time the BoE base rate was 7% was the late 1990s, we’re unlikely to get back to current levels anytime soon under the new rules – meaning this is a significant win for the City and aggrieved banks who believe the FOS often goes too far in consumers’ favour and doesn’t make consistent rulings. Chancellor Rachel Reeves announced in her last Mansion House speech in November that she was going to reform the FOS

The changes will come into force from 1 January 2026.

Reminder: Reeves will address Mansion House tonight.

The rise in the FTSE 100 this year will be a boost to those who invest in London-listed companies through their pension or ISAs.

But it doesn’t tell us much about the state of the UK economy.

Most of the index’s largest members are multinationals, such as pharmaceuticals firm AstraZeneca, HSBC bank, energy producer Shell and consumer goods maker Unilever.

Estimates suggest around 75% of the aggregate earnings of Footsie companies are made in foreign currencies, primarily the US dollar.

Credit data company Experian is leading the FTSE 100 risers this morning, while housebuilders’ shares are sliding.

Experian is up almost 5% in early trading, after cheering traders by reporting 8% organic revenue growth in the first quarter of the financial year.

But housebuilder Barratt Redrow is at the other end of the leaderboard, down 8%, after reporting that home completions in the year to 29 June were “slightly below” its guided range.

Barratt Redrow blamed “the impact of fewer international and investor completions than expected in our London businesses”.

It also reported it took charges totalling £98m to address fire safety issues at several properties – a large development in London, and four buildings in the south.

In total, it recognised “additional legacy property liabilities” of £248m for the last year, from the push to make buildings safer following the Grenfell Tower disaster.

Chris Beauchamp, chief market analyst at IG, says:

“Barratt Redrow shares have fallen out of bed this morning after it emerged it would have to pay up for remedial works on some projects.

The news has overshadowed a generally positive update, with shareholders evidently worried that other costs will emerge in the months to come. Barratt Redrow’s flat share price over a decade reflects not just policy headwinds but the company’s own failure to adapt. It’s been slow to reduce London exposure, late on cost control, and is now burdened with merger complexity and legacy liabilities.”

Bank of England eases rules for challenger banks

Kalyeena Makortoff

The Bank of England is easing rules for challenger banks, in a move meant to give a leg-up to mid-size lenders like Metro Bank and Starling.

One of the biggest changes involves changing rules around so-called MREL – or “Minimum Requirement for own funds and Eligible Liabilities”- which is one of the financial safety nets introduced in the wake of the financial crisis and came into force in 2016.

The Bank is raising the threshold at which smaller banks have to hold emergency funding that would ensure they can wind down without taxpayer support if they fail.

It means that, going forward, banks will only become subject to that emergency funding once their assets total £25bn-£40bn, compared to current thresholds which start from £15bn-£25bn. (It’s within that range that the BoE decides how to apply the MREL requirements, and which would be most appropriate for the bank in question)

MREL, which is made up of a mix of loss-absorbing debt and equity, will now be reviewed and thresholds updated, every three years starting in 2028, to reflect wider economic growth.

The Bank’s Prudential Regulation Authority has also announced “prospective plans” that would “make it easier for mid-sized banks to compete in the mortgage market.

There are few details so far, but the PRA said it will publish a discussion paper this summer that would give mid-sized lenders the ability to “adjust some barriers” to gaining permission from regulators to build their models that measure the risk of residential mortgages on their books (known as Internal Ratings Based Models).

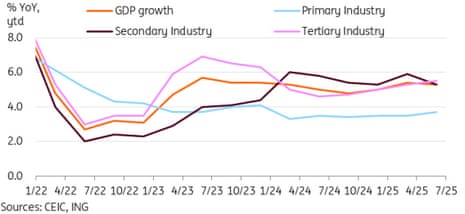

China’s GDP growth slows, but beats forecasts

The financila markets have also been cheered by the news today that China’s economy grew faster than expected in the second quarter of this year.

The world’s second-largest economy grew by 5.2% in the April-June quarter compared with a year earlier, beating forecasts of a 5.1% rise.

That’s still a slowdown from the 5.4% annual growth recorded in the first quarter, but means Beijing is still on track to hit its GDP target for 2025 of “around 5%”.

Activity appears to have been lifted by a rush to beat new US tariffs on Chinese goods.

“China achieved growth above the official target of 5% in Q2 partly because of front loading of exports,” said Zhiwei Zhang, chief economist at Pinpoint Asset Management, who added:

“The above target growth in Q1 and Q2 gives the government room to tolerate some slowdown in the second half of the year.”

A 6.8% rise in industrial production in June also boosted China’s GDP in Q2.

Lynn Song, chief economist for Greater China at ING, explains:

The biggest beat in June monthly data was in the value added of industry, which surprisingly bounced back to a three-month high of 6.8% YoY, up from 5.8% in May, bucking expectations for a further slowdown.

June industrial production benefited from a pickup of manufacturing (7.4%), in particular hi-tech manufacturing (9.7%), which has been an outperformer amid China’s transition up the value-added ladder.

RBC Brewin Dolphin: why the FTSE 100 has reached 9,000 points

John Moore, wealth manager at RBC Brewin Dolphin, says there are several reasons behind the FTSE 100’s ascent to 9,000 points today.

“The FTSE 100 has been driven to the 9,000-point milestone by several factors. Firstly, while the index’s composition had been a brake on its progress compared to other markets, now it is providing a tailwind, with strong earnings momentum in the banking and defence sectors, in particular, supported by the likes of some of the larger operators in other industries such as Next, Tesco, and National Grid.

“Currency has also played a role, though its impact is likely to fluctuate over time. If UK earnings grow by, say, 7-8%, but the pound moves 2-4% relative to the dollar, then you can meet or exceed what you might reasonably expect from the US market with the added benefit of sectoral and stylistic diversification in your investments.

“At the same time, the UK still offers robust income and optionality. That may have been out of favour in recent years, but the cash flow can be helpful in terms of managing a portfolio and providing a form of income beyond cash yields and bonds. And, while resource companies – which often produce a reasonable level of income – haven’t been working out recently, that could turn and provide some cyclical upside along with some indirect exposure to China.

“A number of UK companies have been taking self-help measures, with lots refining their portfolios and buying back shares. Oxford Instruments is a prime example, selling a non-core asset at a good price and then undertaking a £50 million share buyback programme. The likes of Hiscox and DCC have done similarly, and it is becoming more universal.

“Finally, the UK offers relative political stability compared to other parts of the world at present. While there may be tax increases to come, which was part of the reason for the sell-off of the pound in early June, the government has a clear mandate and tenure for the next few years. That compares favourably to other parts of Europe, even, where coalition governments are having a tough time.”