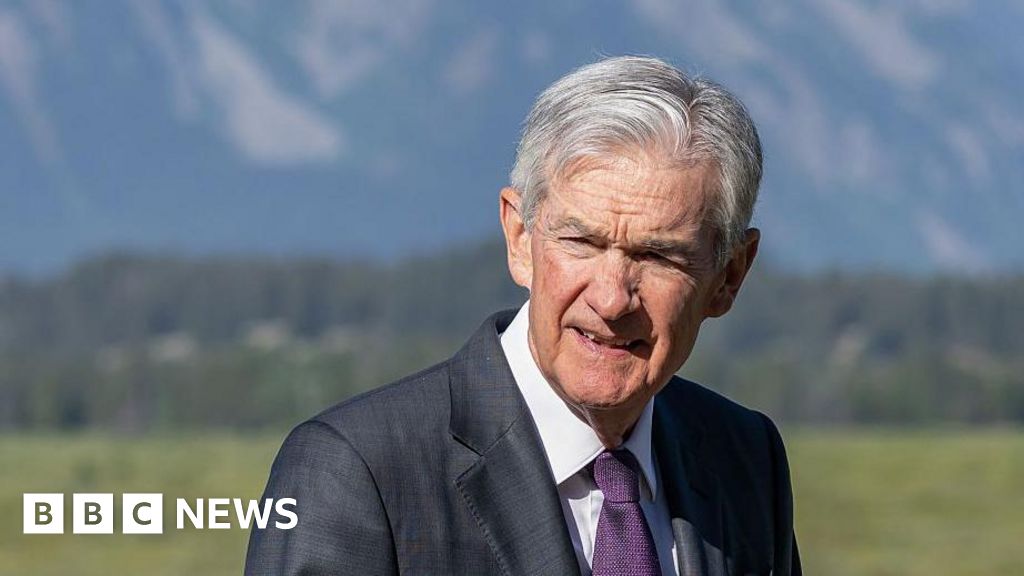

Jerome Powell, the head of the US central bank, has given a rocket boost to expectations that there will be an interest rate cut in September, a move President Trump has been demanding for months.

Speaking to central bankers gathered at Jackson Hole, Wyoming, Powell also argued that the inflationary impact of Trump’s tariffs could prove temporary.

But he did not, as some had expected, address the additional challenges he has faced in recent months: the political pressure exerted on the US central bank, Trump’s barrage of name-calling and demands for Powell to be removed from his post.

The shift to a more “dovish” stance, suggesting an easing of the cost of borrowing, sent share prices higher.

Economists and investors were already expecting borrowing rates to come down from their current 4.25 to 4.5% range. Recent weakness in the US jobs market raised those expectations further, but the impact on prices of Trump’s sweeping tariffs had raised doubts.

“In the near term, risks to inflation are tilted to the upside, and risks to employment to the downside—a challenging situation,” Powell said.

Central banks typically cut rates to boost growth if there are signs of slowing economy and falling employment, as it makes it cheaper for consumers and businesses to borrow.

But boosting growth has to be balanced with keeping a check on rising prices. Higher interest rates can help control inflation, which is often seen as a central bank’s main priority.

Powell said the effects of tariffs on consumer prices were now “clearly visible” but said that there was a “reasonable” case to be made that inflation would be “relatively short lived – a one-time shift in the price level”.

He said it would take time for the price changes to work their way through, but he downplayed the likelihood of inflation becoming embedded due to increased wage demands, or higher inflation expectations.

As interest rates were already “in restrictive territory” – high enough to be having a dampening impact on economic activity – Powell suggested that “the shifting balance of risks may warrant adjusting our policy stance”.

The only time Powell appeared to make reference to the extra pressure exerted by the Trump presidency was when he cautioned against a presumption that a September rate cut was set in stone.

He said: “Monetary policy is not on a preset course”.

Members of the policy making committee would take the decision “based solely on their assessment of the data and its implications for the economic outlook and the balance of risks.

“We will never deviate from that approach,” he said.

Friday’s speech is likely to be Powell’s final address to the annual gathering of the country’s central bankers in Jackson Hole, as his term comes to an end in May 2026.

He was appointed chairman of the Federal Reserve by Trump in 2017.

Since then however Trump has expressed increasing animosity, hurling personal insults at the central banker, including calling him a “numbskull” and a “stubborn moron”, because he did not support the president’s calls for rapid, large cuts to borrowing rates.

Trump has also publicly raised the idea of removing Powell from his post early, although it is not clear that he has the legal authority to do so.

Earlier this week the president called for another of the Fed’s officials, Lisa Cook, to resign, over alleged mortgage fraud. She said she would not be “bullied” into leaving.

Investors welcomed Powell’s speech, pushing the main American share indexes sharply higher in the minutes after he began speaking. By the end of the day’s trading in the US, the broad S&P 500 index was around 1.5% higher.

Brian Jacobsen, chief economist at Annex Wealth Management, said the Fed had opted against being the “party-pooper”.

“Chair Powell has shown he has an open mind to reading the data tea leaves,” he said.

Diane Swonk, chief economist at KPMG US said: “Powell opened the door a little wider to a cut in rates in September.”

But she said the Fed clearly remained concerned about the risk of rising prices.

“There is more caution than the markets are giving him credit for,” she said.

Capital Economics’ deputy chief North America economist, Stephen Brown, said that while a September rate cut now looked “almost nailed on”, higher job creation or “much more concerning” price data in August could still trigger a delay.