Nikkei 225 Index Hits Record High Amid Political Changes in Japan

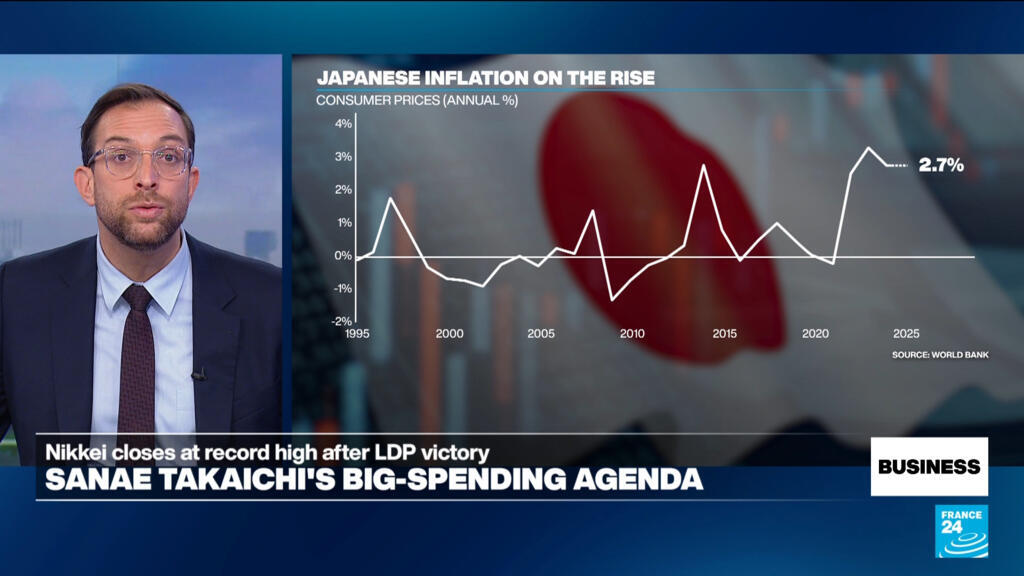

The recent surge of the Nikkei 225 index in Tokyo marks a significant moment in Japan’s economic landscape. Following the decisive victory of Prime Minister Sanae Takaichi’s ruling Liberal Democratic Party (LDP), we are witnessing a blend of optimism and caution in the financial markets.

A New Era of Ambitious Spending

Prime Minister Takaichi’s election campaign was built around an ambitious big-spending agenda aimed at revitalizing the economy. This has undoubtedly been well-received by investors who are always on the lookout for growth opportunities. However, while the immediate reaction has been positive, several underlying factors warrant a closer examination.

- Record Index Performance: The Nikkei 225 index reached new heights, indicating a strong confidence in the LDP’s policies and Japan’s economic recovery.

- Investor Sentiment: The welcome of Takaichi’s spending plans reflects a belief that government intervention can stimulate growth in a stagnant economy.

- Concerns Over National Debt: Japan’s debt stands at approximately 230% of its GDP, a staggering figure that raises questions about the sustainability of such spending.

The Balancing Act Ahead

As we move forward, the challenge will be to balance aggressive fiscal policy with the realities of an already high national debt. The government must not only focus on stimulating growth but also consider the long-term implications of its financial strategies.

In conclusion, while the record performance of the Nikkei 225 index signals a positive outlook, it is essential to approach this development with a mix of optimism and caution. The coming months will be crucial in determining whether Takaichi’s policies will lead to sustainable growth or exacerbate existing financial challenges.

For further details and insights, I encourage you to read the original news article here.