Business Reporter

Getty Images

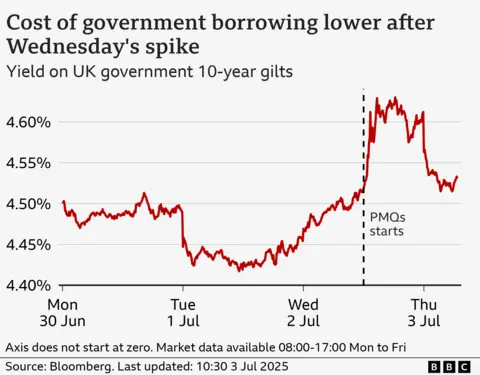

Getty ImagesThe cost of government borrowing has fallen in early trade, partly reversing a surge prompted by the chancellor’s emotional appearance in the Commons the previous day.

The yield on UK 10-year bonds fell to 4.52%, down from 4.61% at Wednesday’s close – as markets reacted to the prime minister’s comments that he worked “in lockstep” with Rachel Reeves.

The pound, which also fell on Wednesday, rose to $1.3668, although it has not regained all the ground it lost.

One analyst told the BBC that financial markets seemed to be backing the chancellor, afraid that if she left her job then control over the government’s finances would weaken.

“It looks to me like this is a rare example of financial markets actually enhancing the career prospects of a politician,” Will Walker Arnott, head of private clients at the bank Charles Stanley, told the BBC’s Today programme.

“I think the markets are concerned that if the chancellor goes then any fiscal discipline would follow her out the door and that would mean bigger deficits.”

Mohamed El-Erian, president of Queens’ College, Cambridge, and chief economic adviser at Allianz, warned that markets were likely to remain on edge.

“The minute you put a risk premium in the marketplace, it’s very hard to take out,” he told the Today programme.

“I suspect that we will see some moderation, but we will not go back to where we were 24 hours ago.”

One reason sharp movements in bond yields matter to individuals is because they can have an impact on the mortgage market, with higher yields potentially making mortgage deals more expensive.

Rises or falls, particularly in five-year bond yields, can feed through to so-called swap rates which lenders use to price their new fixed mortgage deals.

This was most obviously made clear following the mini-budget during the premiership of Liz Truss.

Mortgage rates have been steady of late, with lenders making some relatively small cuts as they compete for customers.

Reeves was at Prime Minister’s Questions on Wednesday, following the government’s U-turn on plans to cut billions of pounds through welfare reforms, when she became emotional and started crying.

The reversal of welfare reforms puts an almost £5bn black hole in Reeves’s financial plans.

The rise in borrowing costs was initially sparked by the feeling the chancellor might step down, seeming to indicate that the markets are supportive of her.

A Treasury spokesperson later said the chancellor was upset due to a “personal matter”.

On Wednesday evening, Prime Minister Sir Kier Starmer backed Reeves, telling BBC Radio 4’s Political Thinking with Nick Robinson that he worked “in lockstep” with Reeves and she was “doing an excellent job as chancellor”.

Reeves has said her fiscal rules are “non-negotiable”. One is that day-to-day spending should be paid for with government revenue, which is mainly taxes. Borrowing is only for investment.

Christian Kopf, head of fixed income at the investment bank Union, told the BBC markets were worried about the future of the fiscal rule in the UK and the “consistency of economic policy”.

“Rachel Reeves stands for that fiscal rule,” he said and investors were concerned about the prospect of “very high fiscal deficits that would no longer comply with the fiscal rule and that would then give rise to higher yields and weaker pound sterling”, if the chancellor was replaced.

The prime minister had done the “right thing” in backing the chancellor,” he added.

“We need some clarity now whether there will be tax hikes, potentially VAT hikes, or a cut in government spending, potentially welfare spending – either one is fine – but we just need some clarity now.”